Few learnings in VC and Angel Investor’s interactions

The following picture is from American Tv Drama ( X-files Mulder and Scully – fictional characters ). They are FBI agents in TV drama.

Getting VC/Angle investors is like “X-files mission”. You need dedicated agents like Mulder and Scully.

The convincing prospective investor is Mission Impossible (task) . This is like startup’s need to think, why are we at this stage?.

Venture Capital /Angel Investors

Pitch Desk, Pich Deck, Pitch deck

This is key document are slide pack, which is starter point to connect prospective investor to potential firm

You can have multiple versions depending on the investor and their segment.

1. Elevator pitch

2. One minute pitch

3. 5 /15/30 minutes pitch

Not every pitch deck satisfies all the investors.

- Charted accountants want to see numbers, projections, balance sheets.

- Technical people are comfortable with technology

- VC and HNI want to see ROI

- Some people want disruptive innovations

- Some people, how do you ensure amount invested?

- Is it in single person’s control?

- Do we have distributed team?

- What if this fails, do have an exit strategy?

Pitch deck contents

- Business/ Service/Product/ Platform name

- Benefit line

- As amazon, we are e-commerce platform

- Current Problem

- How are we addressing the same?.

- Visual demo

- To showcase the product to prove the prototype is done

- Business proposition

- Mention in crisp

- What will you offer to whom, why, for what and the benefits of doing?

- How does your business work?

- Explain the process of executing your business

- Some flowcharts or live demo or Video

- Proof of traction

- Early customers

- And roadmap

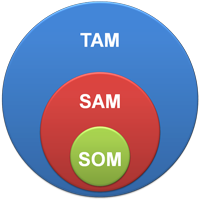

- Market size and potential

- TAM (Total Available market ): Total market for product or service

- SAM (Serviceable Available Market) : It is segment of the TAM targetted by your products and services

- SOM( Serviceable Obtainable Market): It is the portion of SAM, you can capture

- Competition market

- How do we differ?

- Is there any threat?

- How near, How far, which areas they can have our cake?

- Product differentiator

- Go To Market strategy

- How are you taking this market live?

- Sales, Marketing

- 30/60/90/120 days plan

- Core strategy

- simple plan, which we can explain

- Financial Model

- Is it Value driven or Volume?

- “One-time payment model” or “subscription model”

- How big can this grow?

- Why are you looking

- Why do you need funds?

- When do you need funds?

- Current investors?

- Total invested?

- Total pool

- Equity

- What stage?

- Seed, Round A, Round B

- Cash flows

- Revenue streams

- Threats, Death, weakness

- Outcome of the business

- Founder and team

What happens after pitch deck?

- Most of the people have discussion on valuations, how to invest

- The process continues 🙂

- Several questions

- Several pitch decks

What is the typical time frame close on funding?

- Million dollar question

Hope this helps!